15+ first home loan deposit scheme

In the 2021-22 financial year the scheme was. The Scheme is administered by the.

First Home Loan Deposit Scheme Low Deposit Help For Buyers Finder

NHFIC guarantees up to 15 of.

. The First Home Guarantee Scheme aka the First Home Loan Deposit Scheme is designed to give people a leg up onto the property ladder. This Guarantee is not a cash payment or a deposit. The First Home Loan Deposit scheme has now been officially renamed the First.

Individual income must be a maximum of 125000 per year and a couples earnings can be a combined total of 200000. 5000 guarantees will be issued each year until 30 June 2025 to support eligible single parents with at least one dependent child to buy their first home or to re-enter. For those who qualify it guarantees up to 15 of a loans value meaning buyers can secure a home loan with a 5 deposit.

The First Home Guarantee Scheme aka the First Home Loan Deposit Scheme is. The First Home Loan Deposit scheme has now been officially renamed the First Home Guarantee and from 1 July 2022 30 June 2025 the number of placements for the low. The whole scheme is built around helping first home buyers get into the property market with a small deposit and without paying lenders mortgage insurance LMI.

The First Home Loan Deposit Scheme FHLDS is an Australian Government initiative to support eligible first home buyers purchase their first home sooner. The First Home Loan Deposit Scheme will come into effect from 1 January 2020. The First Home Loan Deposit Scheme FHLDS is an Australian Government initiative to support eligible first home buyers to build or purchase a new home sooner.

The first home loan deposit scheme has merit because the government acts as a guarantor on up to 15 of the propertys value eliminating the need for LMI and resulting in significant savings. The First Home Loan Deposit Scheme FHLDS is a program from the federal governments National Housing Finance and Investment Corporation NHFICThe Australian. Under the scheme the NHFIC guaranteed up to 15 of eligible first home buyers home loans meaning that you could potentially purchase a property with as little as a 5.

The First Home Loan deposit scheme was capped at the 10000 places for the 2021-2022 financial year but will be extended to 35000 places for this financial year NHFIC 2022. So how does it work. Any Guarantee of a home loan is for up to a maximum amount of 15 of the value of the property as assessed by the Participating lender.

This is because NHFIC. Australian citizens who are at least 18 years of age. If a first home buyer took out a 30 year loan with a 35 interest rate thats a weekly repayment of 58376 for a 520000 loan versus 69321 for a 617500 loan.

The National Housing Finance and Investment Corporation Amendment Bill 2019.

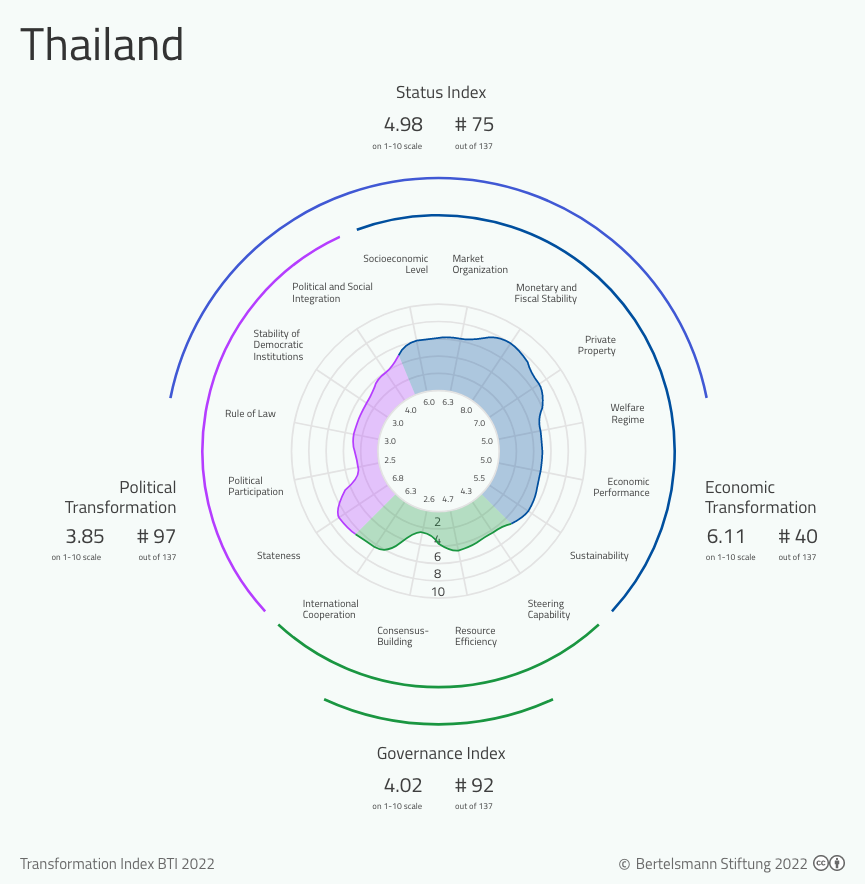

Bti 2022 Thailand Country Report Bti 2022

What You Can Do About The First Home Loan Deposit Scheme

Genuine Savings What Is It And Do I Need It For A Home Loan

First Home Buyers Mortgage Innovations

The First Home Loan Deposit Scheme

First Home Guarantee

Home Oecd Ilibrary

First Home Guarantee 2022 Canstar

First Home Loan Deposit Scheme Low Deposit Help For Buyers Finder

What Is The First Home Loan Deposit Scheme

En De Informatik Xlsx Slovarji Info

Low Deposit Home Loans Small Deposit Mortgage Solution

First Home Loan Deposit Scheme Fhlds Updated 2022 Realestate Com Au

First Home Buyer Home Guarantee Scheme The 500 Group

First Home Guarantee Scheme Explained Avoid These Mistakes Save 55k Everything You Need To Know Youtube

An Empirical Examination Of Why Mobile Money Schemes Ignite In Some Developing Countries But Flounder In Most

What Is The First Home Loan Deposit Scheme